All you need is to use the Maya app for your daily transactions. Maya offers one of the highest interest rates for savings accounts in the country, making it much easier to reach your financial goals. Even better, you can grow your savings more by boosting your interest to 6%.

Simply use Maya for your everyday needs and spend an accumulated amount of P250 with any of these transactions:

1. Pay via Maya QR

2. Pay with Maya mobile number

3. Pay Maya card

4. Settle a bill in your Maya app

5. Buy load via the Maya app

Completing ANY of these transactions lets you earn 6% interest p.a on your Savings for 30 days - credited daily! This offer is available until February 28, 2023.

Accessing Maya Savings is easy, you only need an upgraded Maya wallet account - no need to submit multiple documents or line up in traditional bank branches. You can open an account in just 24 hours! Once you have your Maya Savings account, you do not need to worry about a minimum deposit or maintaining a minimum balance either.

Opening and keeping an account is so much easier than your traditional banks. Plus, fund transfers to other banks and financial institutions via PesoNet are free until December 31, 2022.

Saving with Maya is not just rewarding and reliable, it also has unique and innovative features that make money management feel like a good time.

Opening and keeping an account is so much easier than your traditional banks. Plus, fund transfers to other banks and financial institutions via PesoNet are free until December 31, 2022.

Saving with Maya is not just rewarding and reliable, it also has unique and innovative features that make money management feel like a good time.

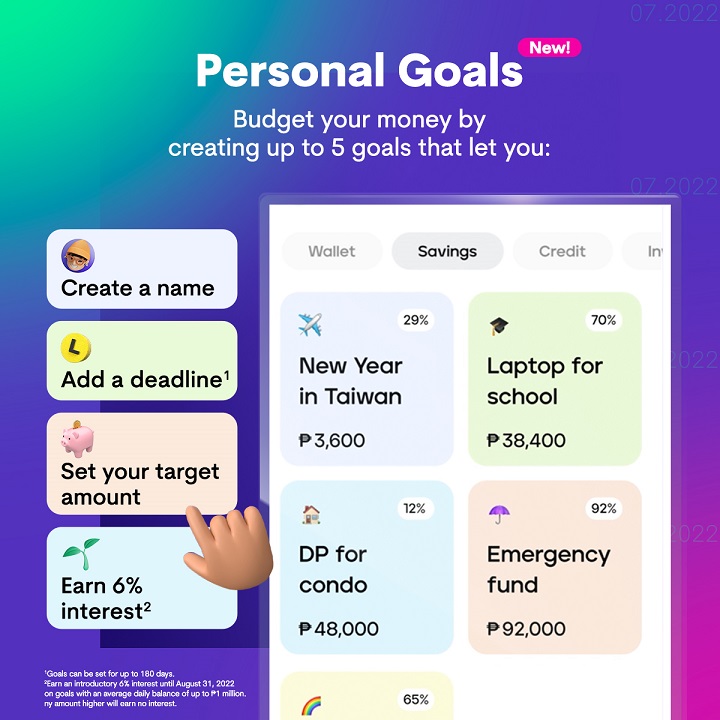

Personal Goals – Maya lets users compartmentalize their savings based on different purposes or money goals – be it their dream vacation, emergency funds, or business capital. This feature makes saving much more efficient and fun for users.

Send money via username – recently introduced feature by Maya that lets customers send and receive money using @usernames. This makes transferring funds safer, more personal, and fun – because sending money is just as easy as tagging your friends on social media. Users can also include GIFs when sending money to their friends/family. Maya is the first PH fintech app to offer this feature.

Soon, Maya will also launch its dark mode feature.

Maya has a record of reliability and safety. The Maya app enjoys a 99.94% app uptime rate. Its digital banking services is powered by the Bangko Sentral ng Pilipinas (BSP)-licensed Maya Bank, and deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to PHP 500,000.00 per depositor.

Now is the best time to kickstart your 2023 goals and save with a reliable digital bank that offers you the best rewards. Download Maya—your all-in-one money app at the

Soon, Maya will also launch its dark mode feature.

Maya has a record of reliability and safety. The Maya app enjoys a 99.94% app uptime rate. Its digital banking services is powered by the Bangko Sentral ng Pilipinas (BSP)-licensed Maya Bank, and deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to PHP 500,000.00 per depositor.

Now is the best time to kickstart your 2023 goals and save with a reliable digital bank that offers you the best rewards. Download Maya—your all-in-one money app at the

Apple store and Google Playstore. And follow Maya on Facebook for more updates. To know more about Maya’s latest offers, check out maya.ph/deals.

No comments:

Post a Comment