In today's new normal, Having a mobile service that gives you control and allows you to bank whenever necessary is essential. Komo, powered by EastWest, is a digital banking service that can go beyond meeting your needs that fits your on-the-go lifestyle.

Standing From Left to Right: Mikey Favis (Marketing Manager), Dennis Medina (Lead Developer), Bam de Mesa (Marketing Services Associate), Harvey Libarnes (Chief Commercial Officer), Chris San Pedro (Chief Technology Officer) Seated from Left to Right: Krisia Cruz (Chief Product Officer), Isabelle Yap (Business Head), Rocio Rentuza (Head, Banking Operations)

Real banking on the go

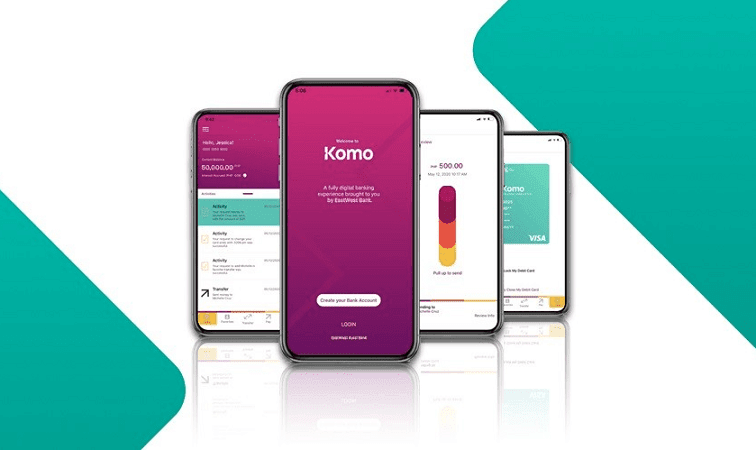

Komo is always available since it's a fully digital platform. Need an account? Save time by avoiding going to the bank to line up. You can open a free account in minutes with just one 1 valid ID, the Komo app, and a reliable internet connection.

Simply download the free Komo app from the App Store or Google Play on your iOS or Android smartphone, and you're set.

Ever need cash on vacation? Each Komo account comes with a free VISA debit card that enables you to do cashless transactions and lets you withdraw for free nationwide. Speaking of travel, the app allows you generate a bank certificate to apply for visas without visiting a branch.

Komo also lets you transact even if your SMS OTP is delayed using biometrics, you can authorize transactions with just your face ID or fingerprint for a quicker and more secure experience.

Securing your present and your future

With an annual interest rate of 2.5%, Komo allows you to park your money and earn interest at a faster rate than traditional institutions.

Transactions and log-ins are already secured using biometrics via the app for a safe, seamless, and OTP-free experience, but Komo takes security to the next level by allowing you to lock your card via the app. Thus, when you travel overseas or are constantly on the move, you may rest assured that you can protect your account against theft, fraud, and even budols!

Last but not least, Komo allows you to create your own insurance plan. No longer do you need to visit a bank or speak with an agent; with just a few taps, you can obtain comprehensive protection that fits your lifestyle and budget (as low as P428 per year!)

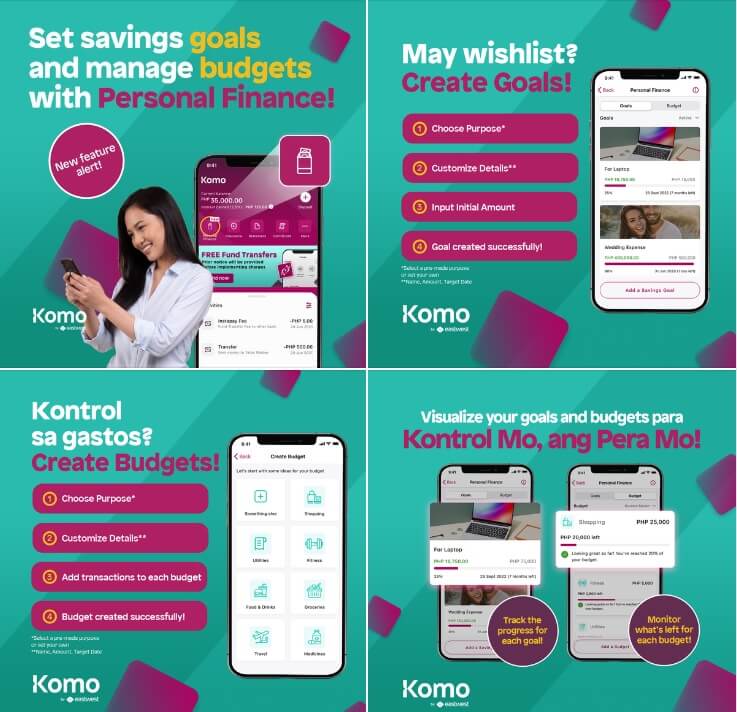

Building solid money management habits

Putting money down for a rainy day or a vacation? Tired of trying to establish objectives and budgets but failing to achieve them? Not only can Komo grow your money faster, but it also helps you develop better money habits. With tools such as Analytics and Personal Finance, you can monitor your expenses, gain insight from your financial flows, and visualize your progress towards your savings goals.

With Komo app, you can make smarter decisions regarding money management. Managing work, leisure, and immediate demands can be challenging. Komo is here to make banking easy and convenient, allowing you to meet your financial needs while on the go.

Komo is more than just an app, it's the perfect choice for your money-smart journey in this new normal. Download the Komo app today! https://www.komo.ph/about-us

No comments:

Post a Comment