Filipinos, who are becoming more concerned about their health and well-being, want faster, more efficient, on-demand service when they seek medical care and health benefits from their insurance plans.

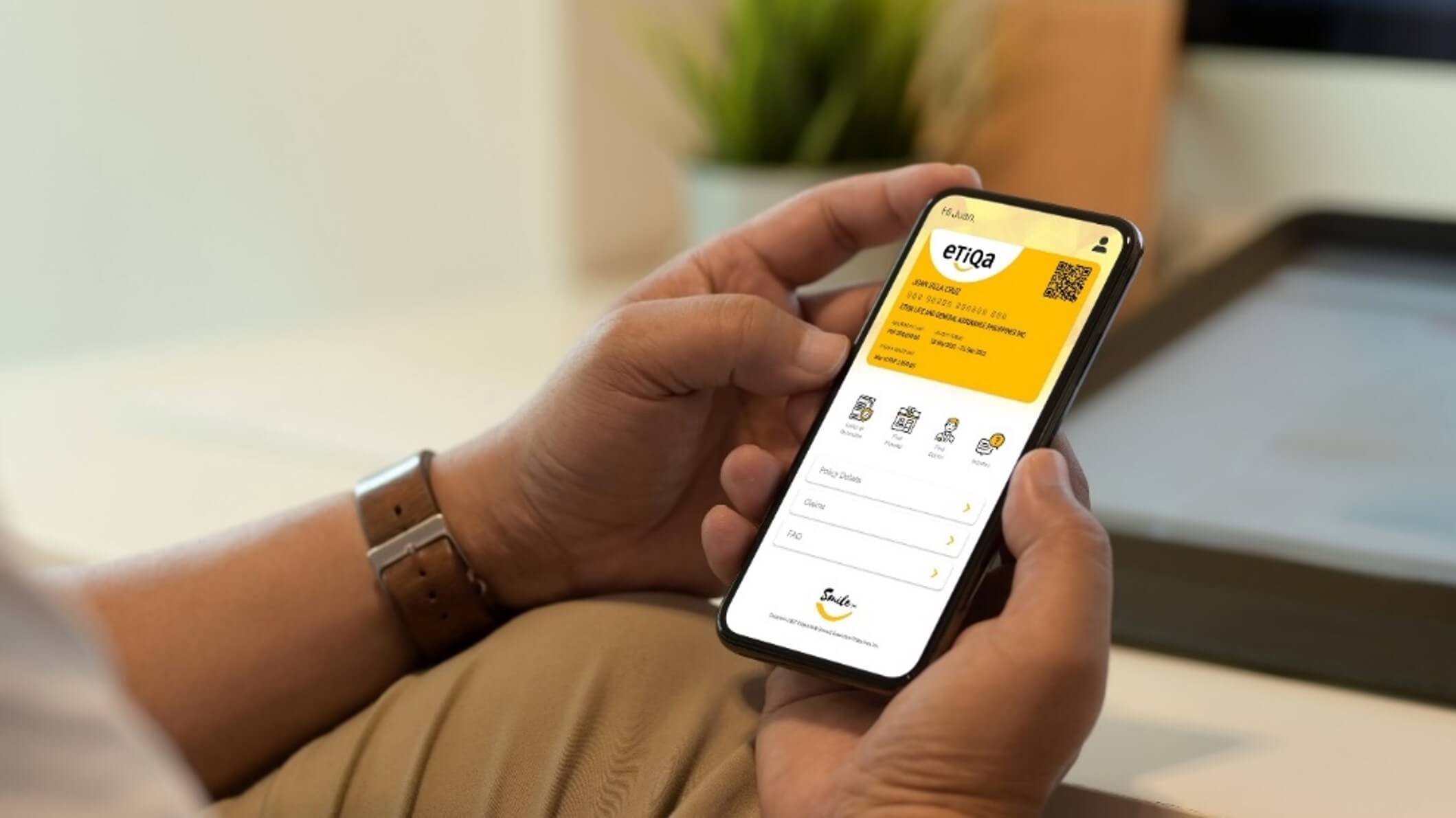

In response to rising customer concern, Etiqa Philippines has relaunched the Smile PH app version 3.0, allowing policyholders to access their health and life insurance products related services, and information wherever and whenever needed.

Smile PH 3.0 is a unified omnichannel app from the country’s leading InsureTech company. It integrates common basic features such as inquiries, profile personalization, and contact details updating with very specific transactional processes to give Etiqa clients a more seamless user experience. Specifically, Individual Life Insurance clients can now manage their insurance plans, view transaction history, request for e-policy, and check fund values through the app.

Meanwhile, for Group Health Insurance clients, the app helps facilitate patient access to its extensive medical network of 30,000 doctors and 1,600 accredited hospitals and clinics nationwide. It also makes the process of filing medical reimbursement claims 50% faster. In addition, they can conveniently view their and their dependents’ coverage plus request letters of guarantee.

“Giving customers the power to view and avail their insurance benefits is essential,” said Ariel Meneses, Senior Vice President and Head of Operations and Service Excellence. “Through the unified Smile PH 3.0 app, which can be easily downloaded from Google Play Store and App Store, they can avail of our services swiftly and promptly.”

The move towards an omnichannel customer service model aims to make Etiqa more responsive allowing its clients to connect directly with the organization through an integrated platform, hotline, email, chatbot, messaging apps, and social media channels. “Our unified Smile PH 3.0 app ensures that we can support our customers – for both Group Health and Individual Life Insurance – in every step of the process.

This is our way of nurturing our relationships with them,” stressed Rico Bautista, Etiqa Philippine President & CEO, who believes that leveraging technology can accelerate insurance market penetration and the growth of the insurance industry – in parallel.

Driving further towards digitalization, Etiqa also provides financial advisors with the training, systems, and devices to make the process more seamless for the clients from the time they get introduced to insurance solutions. Financial advisors can now use Etiqa Sales Evolution (EaSE), which aims to provide a seamless digital customer experience and allows ease of access and comfort to both financial advisors and clients.

With EaSE, financial advisors can interact with their clients freely and quickly, while clients can reach out to their advisors conveniently.

“Gone are the days of overwhelming the customer with pages of printed forms. Their time is valuable and with the pandemic, we also need to adjust fast to remote selling which has become the new normal. The pandemic has undeniably recalibrated the way we do work, bringing digital solutions into the limelight. Right now, we are accelerating our efforts toward a paperless and seamless electronic exchange of data to maintain and improve the company’s productivity during this time,” says Etiqa Philippines Head of Retail Insurance Mars Dailo.

“Our customers inspire us to transform ways to serve them better – and the only way to do it is to embrace the power of technology in all facets of our operations,” he added.

Etiqa also won the 2022 Insurance Asia Awards for Customer Service Initiative for another tech-driven

platform – the Letter of Guarantee (LOG) Portal. Bautista showcased the portal’s case study in the recently concluded Digital Pilipinas Philippine FinTech Festival (PFF), where he highlighted how it improved services, resulting in a 600% increase in response time and 90% customer satisfaction.

Technology and a wide range of relevant, customizable plans catering to various needs can simplify the insurance experience. As one of the handfuls of insurance companies in the country that has a composite license, Etiqa makes it even simpler by offering both life and non-life insurance products under one brand.

To know more about these unified insurance solutions, visit www.etiqa.com.ph.

For more tech news and gadget reviews, please follow us on Facebook (facebook.com/Adobotech), YouTube (Adobotech TechBlog), and Twitter (@adobotech).

No comments:

Post a Comment