In today’s digital world, banks and financial service institutions (FSIs) are responsible for protecting consumers’ critical data to avoid economic and reputational loss. The Bangko Sentral ng Pilipinas (BSP), says that this kind of thing threatens people's privacy and security.

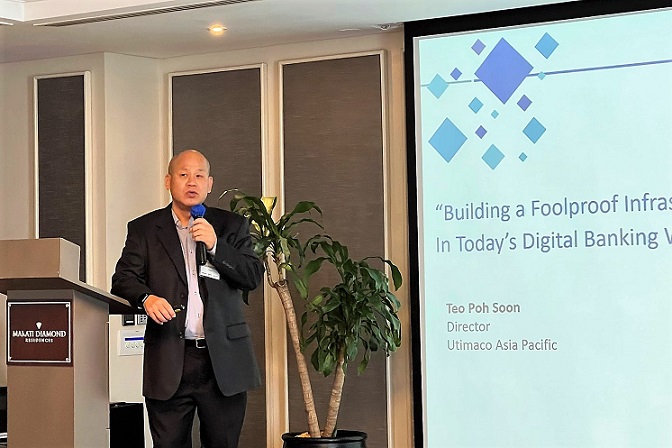

At a recent event themed "Creating a Foolproof Infrastructure in Today's Digital Banking World," hosted by Utimaco in collaboration with Securemetric and CorewareTechnology, corporate executives discussed how to protect sensitive data in the age of digital banking.

Understanding the data ecosystem

Card payment systems typically use the "Four-Party Model." This involves the cardholder, a customer with a payment card from a bank or other financial institution, and the merchant, a business, or an individual who accepts card payments for goods and services. ATMs, which accept cards, are in this category.

The issuing bank, which issues payment cards for card networks, is also important. In this approach, the issuer pays the acquiring bank for the cardholder's purchases, and the acquiring bank pays the issuing bank according to the contract conditions.

Finally, the acquiring bank It holds the merchant's bank account. Businesses can accept all cards through acquirer contracts. While the architecture is basic, the four parties transmit vital data that might be at risk if not safeguarded.

Using cryptographic methods for data security

Cryptography protects consumers' private data during online transactions. Tokenization and encryption. The former uses an algorithm to convert data into ciphertext, which can be decrypted with a key. Meanwhile, the latter converts the data into tokens. Tokens are worthless without tokenization.

In safe transactions, Hardware Security Modules (HSMs) establish, protect, and manage cryptographic keys. In the data ecosystem's four essential parties, HSM applications differ. A card owner's EMV chip is a micro-portable HSM. For merchants, HSM use depends on business size and type. POS terminals with secure memory and cryptographic hardware can operate as HSMs for smaller manufacturers. Yet, major shops need network-attached HSMs for safe transactions.

Meanwhile, the issuing bank needs strong HSMs to generate, safeguard, and maintain payment card keys. The acquirer processes the issuer's cryptographic flow and manages the merchant's financial channel keys with HSMs.

"HSMs secure ciphered transactions across the data ecosystem. A financial institution's network safe holds the keys to decrypting consumers' sensitive data. Data security and identity protection are more vulnerable to fraudsters as financial transactions increase. "HSMs are essential to the data ecosystem's main players," said Utimaco's Asia Pacific Managing Director, Deval Sheth.

Role of HSMs in securing transactions

Utimaco's HSMs securely conduct financial transactions. The Atalla AT1000 is a FIPS 140-2 Level 3 and PCI PTS v3 payment HSM. NayaPay, a Pakistani digital payment services platform, and e-money startup integrated this HSM.

This protects clients' data, identities, and finances while meeting compliance and regulation criteria. After integrating Atalla AT1000, NayaPay obtained comprehensive and flexible transaction protection, integrated HSM infrastructure, and met security and compliance requirements.

No comments:

Post a Comment