During Home Credit’s media event.

This October marks Home Credit's 10th year of operation in the country, and the company has used that time to steadily grow its operations and offer a broader variety of products and services in order to better meet the needs and interests of its customers.

Home Credit concluded 2022 with a solid customer base of 9.3 million. The expansion of its services to many lifestyle segments and categories contributed significantly to Filipinos' ability to afford a more rewarding lifestyle.

Home Credit concluded 2022 with a solid customer base of 9.3 million. The expansion of its services to many lifestyle segments and categories contributed significantly to Filipinos' ability to afford a more rewarding lifestyle.

“Our goal of a financially empowered Philippines comes true every year, one customer at a time. In our 10 years of service in the country, we aim to empower 10 million customers by the end of 2023 and continue to serve more Filipinos in the years to come. More than delivering innovative and accessible financial services, we celebrate the relationships we have built with our stakeholders and customers over the past decade, and this we choose to continue above and beyond,” shares Home Credit Philippines’ Chief Executive Officer, David Minol.

Home Credit, a leading consumer financing company that pioneered buy now, pay later (BNPL) services in the country, has strengthened its local roots and market awareness over the past decade. To meet the changing requirements of this generation of Filipinos, the firm has expanded its lifestyle and finance offerings.

Home Credit has grown to 15,000 partner retailers in 75 provinces and aggressively extended its internet presence through the My Home Credit App. The company has partnered with the country's leading brands and merchants to offer 300+ lifestyle products, including electronics, smartphones, appliances, furniture, bicycles, motorcycle accessories, sports equipment, and more.

Since entering the country in 2013, Home Credit has offered millions of Filipinos more financial solutions.

The company also offers cash loans to existing customers with good payment histories. Home Credit has issued over 1.8 million cash loans, with 90% of contracts completed digitally and 20% processed using the My Home Credit app.

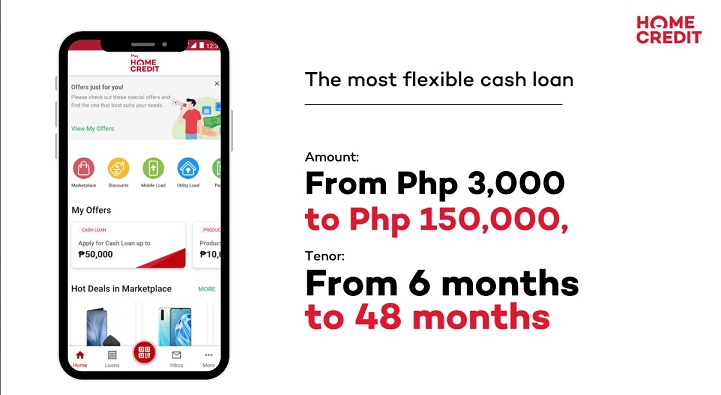

Home Credit boasts the fastest cash loan approval and disbursement in the market at only 1 minute - the best in the market. Cash loan offers from Php 3,000 to Php 150,000 and payback durations of six to 48 months give customers flexibility.

Home Credit believes consumers' journeys begin with its loan offerings. The organization seeks to strengthen its relationships with customers and advocate for proactive safety measures for them and their families.

Home Credit also provides the highest level of client protection. Device Protection, which can be upgraded with an extended warranty for accidental damage protection; Extra Care for flexible payment management; Home Content to protect and cover home belongings from unfortunate incidents; and an innovative Personal Payment Protection that offers unlimited telemedicine service, death, and accident coverage, and medical reimbursement.

Home Credit remains committed to enabling Filipinos, Para sa Life, as their lifestyle partner. Financial literacy supports Home Credit's environmental, social, and governance goals.

Home Credit's flagship financial literacy program, Wais sa Home, touched over 20 million Filipinos last year and ran onsite financial literacy workshops in Pampanga, Iloilo, Guimaras, Capiz, Antique, and Aklan.

Due to digitalization, the organization saves 30 million sheets of paper, equivalent to 2,000 trees. Home Credit also fosters equity by giving its 52% female customers more purchasing power.

Home Credit, the consumer finance market leader, draws strength from its stakeholder and consumer relationships as well as its stats. In its 10th year in the Philippines, the company aims to set a standard in consumer finance through innovation, client happiness, and financial inclusion.

No comments:

Post a Comment