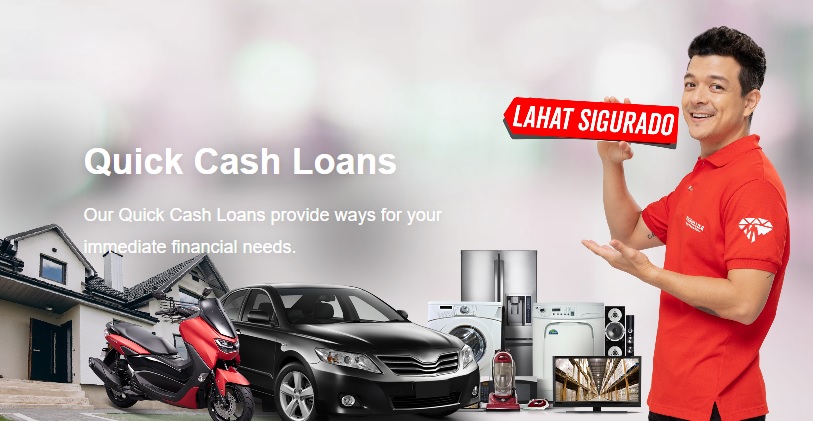

M Lhuillier, a well-known Philippine financial institution, offers the ML Quick Cash Loan for paMLyang Pilipino. Its service is designed to provide quick and convenient financial assistance to those in need.

The ML Quick Cash Loan offered by M Lhuillier has been tailored to address urgent financial needs. Whether it's for medical expenses, tuition fees, home repairs, or unexpected bills, this loan option provides a quick and hassle-free solution. The application process is straightforward, ensuring that borrowers have immediate access to funds.

To meet the requirements of the paMLyang Pilipino, M Lhuillier offers high appraisal rates and low-interest rates via a quick, simple, and dependable system.

Accessibility is one of the major advantages of the ML Quick Cash Loan. The extensive branch network of M Lhuillier makes it easy for consumers to locate a nearby branch and apply for loan assistance.

Also read

To apply for the ML Quick Cash Loan, borrowers need to provide some basic requirements, including a valid ID, a fill-up form provided by the branch, and an appraised item to be used as collateral.

Step 1: Visit M Lhuillier Branch

Visit the nearest M Lhuillier branch in your area during their operating hours. M Lhuillier branches typically operate from 8am until 6pm, there are branches of M Lhuillier that are open earlier at 7am and also operating 24-hours a day (https://mlhuillier.com/branches/), offering convenient access to their services.

Step 2: Fill out the Loan Application Form

Talk to the loan officer or staff at the M Lhuillier branch and inform them of your intent to apply for the ML Quick Cash Loan. You will be given a loan application form to complete. Take your time to accurately complete the form and ensure that all of the provided information is accurate and up-to-date.

Step 3: Submit the Required ID and Collateral Item/s

After completing the loan application form, submit it alongside a valid form of identification and the collateral item(s) for assessment. The loan officer will verify the documents to assess your eligibility and determine the loan amount you can borrow. It's essential to provide a valid ID or ML Diamond Card to avoid any delays or issues during the loan processing.

What items can I use as collateral?

Gold and Diamond Jewelry

Smartphones

Laptops/Macbooks

Tablets/Ipads

Cameras

Kitchenware

Silverware

Appliances

Ray-Ban Sunglasses

Power Tools

Guitars

Medical Equipment

Watches

Motorcycle (selected branches nationwide)

Step 4: Receive the Loan Funds

Once your loan application is approved, the loan officer will provide you with the loan ticket, which includes all the necessary details, such as the loan amount, interest rate, repayment terms, and schedule of payments. Before signing the loan agreement, review it carefully and ask any queries you may have.

Payback the Loan

As with any loan, prompt payment is essential. M Lhuillier offers flexible repayment options, allowing you to select weekly or monthly payments based on your preferences and financial resources. Setting reminders or automating your payments is recommended to avoid missing any installments.

Note: The minimum and maximum period for repayment of a loan is 1 and 120 days, respectively. The service charge is equivalent to one percent (1%) of the principal loan, but shall not exceed five pesos (P5.00). No other charges shall be collected.

It's important to note that loan approval and disbursement are subject to M Lhuillier's policies and guidelines. Meeting their eligibility criteria, providing accurate information, and submitting the required documents play a crucial role in ensuring a smooth loan application process.

M Lhuillier is a trusted name in Financial Services, with a long history spanning over 30 years. The company has built a strong reputation for its reliable and efficient services, catering to the diverse needs of its customers. With a wide network of branches across the country, M Lhuillier has become a go-to option for Filipinos looking for financial assistance.

No comments:

Post a Comment