More Filipino business owners and casual sellers have readily embraced digital payments as a key component of doing business under the New Normal, propelled by ready business-in-a-box solutions from digital financial services leader PayMaya.

As of end-November, the number of micro-, small-, and medium enterprises (MSMEs) utilizing PayMaya's various digital payment acceptance solutions has grown exponentially by 2000% year-on-year, signifying a sea change in how merchants are doing business as a way to cope with the economic effects of the pandemic.

To respond to the growing demand for cashless payments at the height of the quarantine as many merchants turned to digital, the company launched the PayMaya Negosyo app in May. The app enables MSMEs to have their own merchant QR in as fast as 24 hours. They can then readily accept cashless payments via QR, bank transfers, and through e-Wallets, using only their mobile phones.

Aside from this, MSMEs are also able to generate additional income by selling mobile prepaid loads or accepting bill payments through the same app. Soon, qualified businesses may also start accepting remittance transactions through the PayMaya Negosyo app.

Since its launch, the PayMaya Negosyo app has been downloaded hundreds of thousands of times in the Google Play Store and has enabled MSMEs to instantly accept payments via chat, on their social media pages, or through their online stores.

Because of this development, the MSME segment now comprises over 95% of PayMaya's total merchant base in 2020, compared to just 78% in 2019.

PayMaya's solutions are designed to serve the country's more than 1.5 million registered MSMEs which account for more than 99% of all Philippine businesses and provide 62.4% of the country's employment. Based on data from the Department of Trade and Industry (DTI), there are 6 million more micro-enterprises that have yet to formally register, and PayMaya is already enabling this segment through its various solutions.

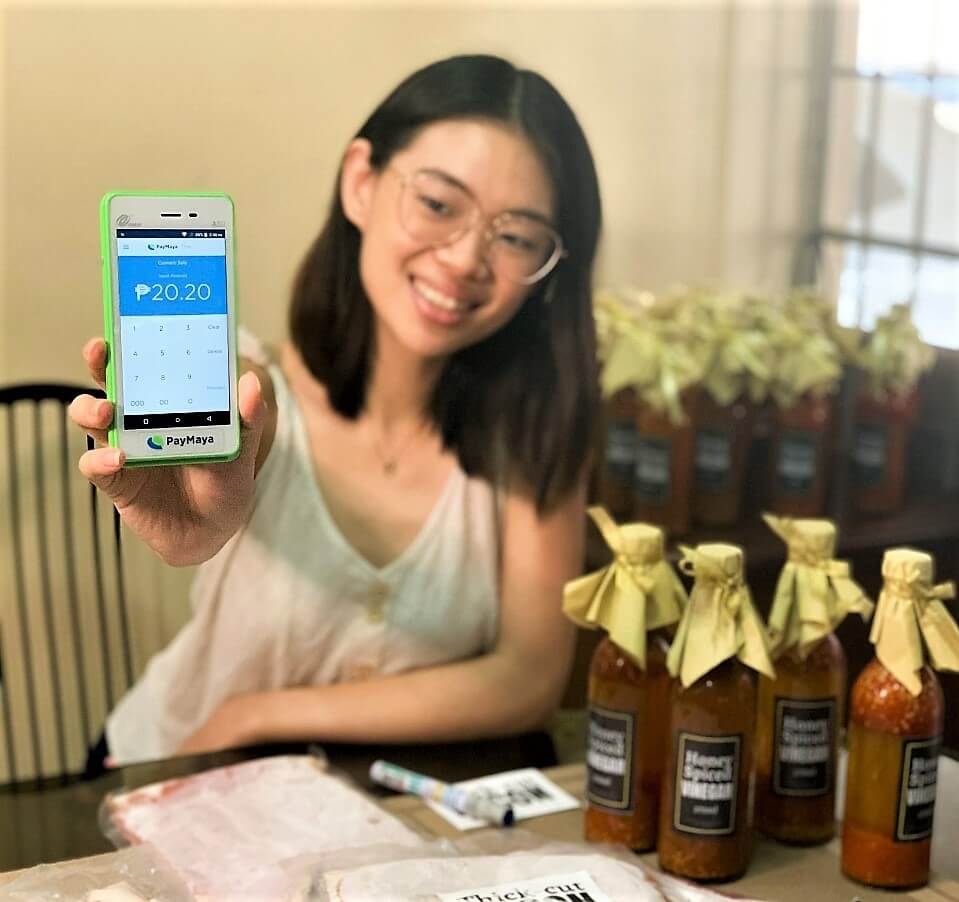

Aside from PayMaya Negosyo, the company also offers the PayMaya One Lite device for the in-store card and e-Wallet payment acceptance, as well as digital payment tools such as Digital QR, Payment Links, and PayMaya Checkout payment gateway plugins which can easily be availed by visiting http://pymy.co/BeAMerchant.

To further help our country's MSMEs, PayMaya has also rolled out innovative programs in close cooperation with DTI and private sector partners such as Go Negosyo.

In October, PayMaya launched the "Sulong Negosyo" Program wherein MSMEs are provided with ready-business-in-a-box tools such as the PayMaya Negosyo app, as well as marketing and rewards opportunities through PayMaya Negosyante Rewards. The program aims to help MSMEs accelerate their transition to e-commerce with the help of digital and cashless technologies.

Aside from this, the company has been working with local government units (LGUs) through its LGUs Accelerating and Embracing Digitalization (LEAD) Program to create digital cashless ecosystems in their respective localities, which includes empowerment of MSMEs to make and accept cashless payments from local residents.

PayMaya has also supported the private sector-initiated "Ingat-Angat Tayong Lahat" campaign that promotes the dual goal of public health safety and economic recovery.

-

No comments:

Post a Comment